Gold Jumps Most In 2017 As 'Mnuchin Moment' Sparks Dollar Dump; Dow Tops 20,800

Mnuchin hit the reset button and then asset gatherers spent the day like this...

The Dow topped 20,800 shrugging off any fears from Mnuchin...thanks to a VIX slam...

Mnuchin hit the reset button and then asset gatherers spent the day like this...

The Dow topped 20,800 shrugging off any fears from Mnuchin...thanks to a VIX slam...

Submitted by Mike Shedlock via MishTalk.com,

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other.

the above image from the New York Times article A History of Fed Leaders and Interest Rates.

Here’s an alternative view courtesy of @HedgeEye.

Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Rate Hike Cycle vs. the US Dollar

By EconMatters

We discuss the wonderful shorting opportunities there are in Financial Markets right now in this video. There are a lot of Market Dislocations right now, many stocks are set up for massive repricings over the weaker investment months of the year.

https://www.youtube.com/watch?v=YYQLy6cD9sk

Submitted by Simon Black via SovereignMan.com,

On May 23, 1719, one of the greatest financial bubbles in the history of the world kicked off when the Compagnie Perpetuelle des Indes was granted a monopoly by the French monarchy over all the trading rights of all French colonies worldwide.

The company’s stock price quickly soared, from 300 livres per share to more than 1,000 just a few months later.

It was quite a jump. But the enthusiasm continued for more than 18-months.

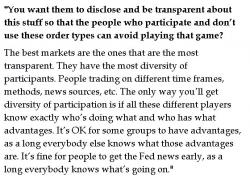

The Banks Will Not Be Denied Franchises and are Buying Into Exchanges

written by Soren K. for MarketSlant