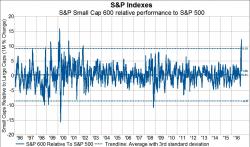

Five 3-Standard-Deviation Price-Moves Post-Election

Submitted by Eric Bush via Gavekal Capital blog,

Most of the time not a whole lot actually changes in the markets over the course of a month. For example, small cap stocks tend to outperform large cap stocks by a rather mundane 31 bps over the course of a month on average going back to 1996. There are, however, periods of time when extreme moves do occur over the course of a month. We have just experienced one of those times.