The Traditional "2 & 20" Fee Structure Is Taking A Hit As Hedge Funds Continue To Underperform

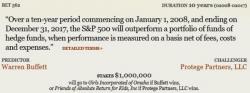

Nearly a decade ago, Warren Buffett bet Protege Partners, a fund of hedge funds, that over the course of 10 years the S&P would outperform Protege's returns net of all fees, costs and expenses. To make it real, the loser agreed to pay $1 million to the charity of the winner's choice.

At this past year's annual meeting, Warren Buffett provided an update on the now 8-year-old bet and, sure enough, the S&P has obliterated Protege's net returns by over 40%, on a cumulative basis.