"When Gold Goes Above 1430 We Whack It"

Submitted by Allan Flynn via ComexWeHaveAProblem blog,

As it goes in silver, so it goes in gold. In London at least.

Submitted by Allan Flynn via ComexWeHaveAProblem blog,

As it goes in silver, so it goes in gold. In London at least.

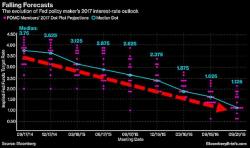

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Over the last few week’s I have discussed the post-election surge in the market based on rather optimistic outlooks as opposed to the technical underpinnings that currently exists. As I specially stated in last weekend’s newsletter entitle “Dow 20,000”:

The market's message to Dow 20,000 (or China's message to 'Murica)?

Thanks to China stealing an underwater drone and quad witch shenanigans, US equities closed red post-Fed...

Submitted by MN Gordon via EconomicPrism.com,

Stimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath.

Stimulus can come in many forms and varieties. It can come in the form of a stick; do this and you won’t get whacked over the head. So, too, it can come in the form of a carrot; do that and you’ll get a reward.

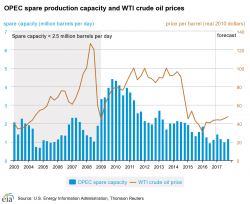

Submitted by Nick Cunningham via OilPrice.com,

Saudi Arabia surprised the world by helping to engineer an unexpectedly strong agreement from OPEC members to cut production by 1.2 million barrels per day, followed by additional cuts from non-OPEC members. While the two agreements incorporate cuts from a wide range of oil producers, Saudi Arabia will do much of the heavy lifting, cutting nearly 500,000 barrels per day and even promising to go further than that should the markets warrant steeper reductions.