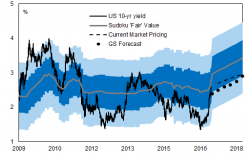

Goldman Warns Bond Yields Are Now "A Threat To Risky Assets"

At the end of November, when the 10Y yield had just cracked 2.3%, Goldman, together with SocGen, JPM, RBC and various other banks, gave its answer to what may be one of the most important questions for the market right now: how high can 10Y bond yields go before they start to hurt equities? Goldman answered that "the equity market is still at a level that can cope with moderately rising bond yields.