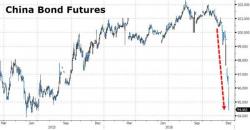

Fed Fallout Escalates: China Bond Market Crashes Most On Record, Yuan Plunges

After a bubblicious surge higher over the last few months (as China's hot money swishes from one trending-higher market to another), China's bond market is collapsing. As Chinese money-markets tighten into new year, yuan weakens, and capital outflows accelerate, so it appears the final bastion of safety has cracked. Chinese bond futures crashed overnight by the most on record, erasing in a week the gains of the last 18 months.