Here's My Shocked Face

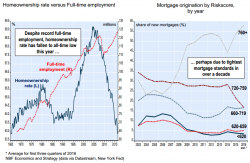

h/t National Bank Financial

h/t National Bank Financial

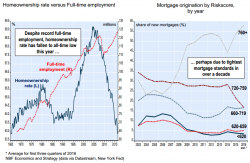

The cashless society is catching up to all of us. As SHTFPlan.com's Mac Slavo notes,

Most of Europe has shifted that way, and now India is forcing the issue. In the United States, people are being acclimated to it, and may soon find that no other option is practical in the highly-digitized online world.

As we noted last night, when we previewed the virtually assured "No" vote, we said that "a strong “No” vote will cause Prime Minister Renzi to resign, leading to political instability in Italy.

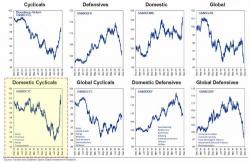

While the big move higher in the US stock market following the Trump victory - a move which it is safe to say virtually every so-called expert, with a few exceptions, called wrong - has been duly noted, and has since started to fizzle, the real story is what has happened below the market's surface, where the rotations from one sector to another in the past three weeks have been unlike anything seen in years.

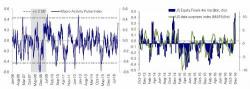

With the last traces of the Trumpflation rally still noticeable, US equity inflows continued last week as positive economic data surprises rose to a 4-year high. Inflows into US equities ($4.4bn) continued for a 4th straight week, cumulatively adding $45bn. This is the longest consecutive stretch of inflows since June 2014, i.e., when the severe dollar shock began.