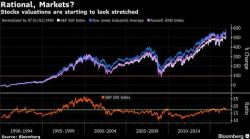

20 Years Later, Greenspan's "Irrational Exuberance" Has Become Even More Irrational

20 years, to the day, after Greenspan's iconic speech that warned of the unintended consequences of "irrational exuberance," we find ourselves, yet again, in the midst of perhaps the largest asset bubble in history. In fact, Greenspan's warning, previously made in a speech on Dec. 5, 1996, eerily reflects many of the same concerns surrounding the market today with low interest rates and lower risk premiums driving an unprecedented equity bubble.