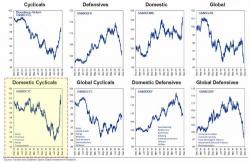

How Trump Made Domestic Cyclical Stocks Great Again

While the big move higher in the US stock market following the Trump victory - a move which it is safe to say virtually every so-called expert, with a few exceptions, called wrong - has been duly noted, and has since started to fizzle, the real story is what has happened below the market's surface, where the rotations from one sector to another in the past three weeks have been unlike anything seen in years.