Jeff Gundlach Warns Yields And Stocks Have Peaked: "The Trump Rally Is Losing Steam"

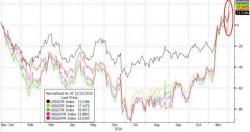

Having predicted the Donald Trump victory, and nailing the upturn in US Treasury yields as well as the concurrent stork market rally, DoubleLine's Jeffrey Gundlach appears to have once again taken the other side of the trade after riding it for the past 3 weeks, and is now considerably less exuberant on Trumponomics.

Speaking to Reuters, Gundlach said that markets could reverse the recent momentum in equities (something they appear to be doing this very moment), and at the very latest by U.S. President-elect Donald Trump’s Jan. 20, 2017 inauguration.