Wall Street Reacts To Steve Mnuchin Choice For Treasury Secretary

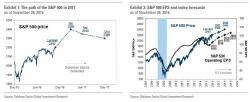

Following the news that Steve Mnuchin would be US Trasury Secretary, Wall Street analysts offered mixed predictions on which policies Donald Trump’s choice for Treasury secretary may pursue, as they have little to go on other than Mnuchin’s background with Goldman, buying/selling the former Indy Mac.