The Simple Analytics of Why President-Elect Trump’s Policies Will Probably Result in a Trade War with China

Authored by Steve H. Hanke of The Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

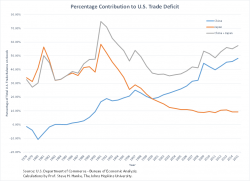

The United States has recorded a trade deficit in each year since 1975. This is not surprising. After all, we spend more than we save, and this deficit is financed via a virtually unlimited U.S. line of credit with the rest of the world. In short, foreigners in countries that save more than they spend (read: record trade surpluses) ship the U.S. funds to finance America’s insatiable spending appetites.