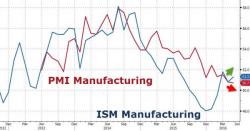

GM, Ford US Auto Sales Tumble In "Bellwether" Month Of May

You can't say we weren't warned. As reported over a month ago, the biggest drag on recent consumer spending was auto sales.

And this is happening as Automaker inventories are at their second highest in 23 years. If sales are collapsing, then the violent spike in relative inventories as seen in 2008 is not far away.