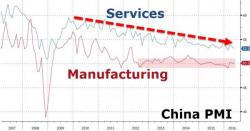

Yuan Tumbles As China PMI Miraculously Hugs The Flatline Despite Steel Industry Orders Crash

Since May 2012, China Manufacturing PMI has miraculously stayed within a 1 point range of the knife-edge 50 level between contraction and expansion. May 2015 just printed 50.1, the same as April with New Orders weaker and business activity expectations (hope) tumbling to 4 month lows. The Steel Industry PMI collapsed from 57.3 to 50.9 with New Steel Orders collapsing from 65.6 to 52.7 - the biggest monthly drop in record.