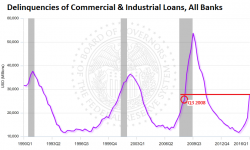

Business Loan Delinquencies Spike To Lehman Moment Level

Submitted by Wolf Richter via WolfStreet.com,

A leading indicator of big trouble.

Submitted by Wolf Richter via WolfStreet.com,

A leading indicator of big trouble.

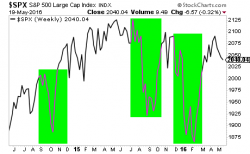

For most investors, the sudden collapses in stocks that we keep experiencing feel they like they come “out of the blue.”

After all, we are told incessantly by the Government and the media that the economy is going strong and that everything is great for the stock market.

If those claims are true, how do you get moments like these, when the market enters a free-fall, erasing months’ worth of gains in a few days?

Submitted by John Rubino via DollarCollapse.com,

Somewhere back in the depths of time the world got the idea that easy money — that is, low interest rates and high levels of government spending — would produce sustainable growth with modest but positive inflation. And for a while it seemed to work.

Now that 13-F reporting season is over, we have the data to compile who bought, who sold, and what the top holdings of the largest hedge funds are.

To help in that endeavor, we used the latest Q1 Hedge Fund quarterly ownership highlights courtesy of FactSet. This is what it found:

Via Dana Lyons' Tumblr,

The prices of industrial metals have dropped to a near-record low level relative to precious metals, a trend that has had larger negative consequences in the past.