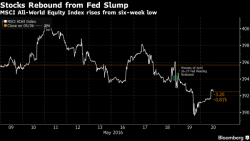

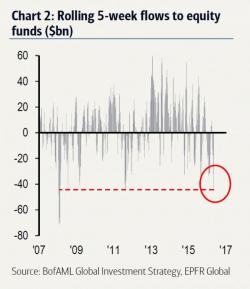

"Shanghai Accord Flows Reverse" - Retail Investors Pulls Money From Stocks For 6 Straight Weeks

One week ago we showed that in a surprising twist, even as the broader market has remains stable and trading rangebound between 2040 and 2080 over the past month, actual equity outflows had accelerated and one week ago EPFR reporter another $7.4bn in equity fund outflows (the 5th straight week) driven by $4.8bn in mutual fund outflows and $2.7bn ETF outflows, leading to a $44bn equity exodus past 5 weeks, which as Michael Hartnett points out is the "largest redemption period since Aug’11."