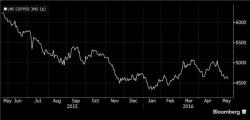

Target Crashes To 2016 Lows After Missing Top Line, Slashing Guidance

How is this possible? The government just told us that retail sales jumped the most in years?

Target is out with its earnings despite beating bottom line, it missed top-line and took an ax to Q2 guidance...

- *TARGET 1Q ADJ. EPS $1.29, EST. $1.19 (Good)

- *TARGET 1Q REV. $16.2B, EST. $16.3B (Bad)

- *TARGET SEES 2Q ADJ. EPS $1.00-$1.20, EST. $1.36 (Ugly)