Can Big Oil Survive At Today's Prices?

Submitted by Arthur Berman via OilPrice.com,

Data suggests that oil producers need prices in the $70-80 range to survive. That is unlikely in the next year or so. Without more timely price relief, the future looks grim for an industry on life support.

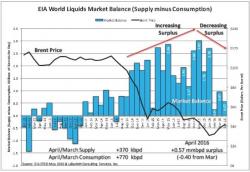

EIA Revises Consumption Upward

Major EIA revisions to world oil consumption* data provide a new perspective on oil-market balance.