The Fed Needs to Raise Rates at the June and December Meetings (Video)

By EconMatters

It is obvious that the unintended consequences of ZIRP have destroyed financial market structure which ultimately flows through to the broader economy.

By EconMatters

It is obvious that the unintended consequences of ZIRP have destroyed financial market structure which ultimately flows through to the broader economy.

Submitted by Michael Snyder via The Economic Collapse blog,

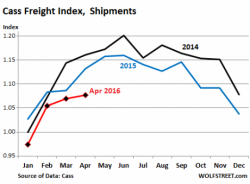

You are about to see a chart that is undeniable evidence that we have already entered a major economic slowdown.

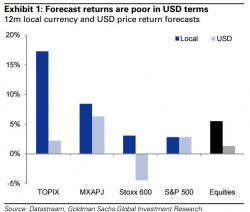

Having pointed out the gathering storm in VIX ETPs, raised concerns of a "reasonably high probability" of a large drop in stocks, and explained how complacently short-term risk is being priced, Goldman's portfolio strategy team have unleashed a dramatic warning. Shifting to an oveweight cash position for the next 3 months, Goldman warns "we downgrade equities to Neutral over 12 months on growth and valuation concerns. Until we see sustained earnings growth, equities do not look attractive, especially on a risk-adjusted basis."

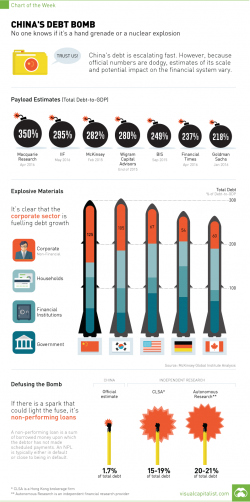

No one knows if it's a hand grenade or a nuclear warhead...

The ramp up in Chinese debt accumulation has been a leading concern of investors for years. The average total debt of emerging market economies is 175% of GDP, and skyrocketing corporate non-financial debt has launched China far beyond that number.

The real question is: by how far?

The answer is disconcerting, as VisualCapitalist's Jeff Desjardins warns, because nobody really knows.

Submitted by Ryan McMaken via The Mises Institute,

Last year, we covered a story coming out of Texas in which the state government was planning to institute a state-controlled "gold depository" that would allow individuals to store their gold in a presumably safe place outside the United States banking system.