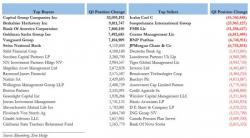

Who Bought And Sold Apple In The First Quarter

Much was made of Berkshire's unexpected infatuation with AAPL yesterday (which was not actually driven by Buffett but by one of his new ex-hedge fund heirs, Todd Combs and Ted Weschler, who have "shown a willingness to wade into other corners"), which catalyzed the recently beaten down stock's biggest surge in months. Not as much was made of the selling in AAPL in the first quarter, but perhaps it should have been because while the Top 20 buyers of AAPL stock added a grand total of 101.5 million shares, the Top 20 sellers liquidated 50% more, or 157.5 million.