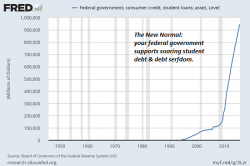

Eight "New Normal" Charts That Are Insanely Abnormal (And Dangerous)

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Is there anyone on the planet who's actually stupid enough to believe these New Normal charts are healthy and sustainable?

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Is there anyone on the planet who's actually stupid enough to believe these New Normal charts are healthy and sustainable?

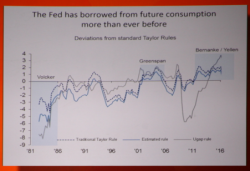

If anyone had wondered if Stanley Druckenmiller's recent bearishness had dissipated, or transformed into at least modest bullishness as a result of the market meltup, we have bad news.

Moments ago at the Sohn Conference, Druckenmiller raged at the Federal Reserve's dire monetary policies, saying that low interest rates have caused an environment where "not a week goes by without someone extolling the virtues of the equity market." The obsession with short term stimulus contrasts with the monetary reform of 80's which led to the bull market, he added.

If ever one was in doubt about whether or not a brand can still command a premium price in the market, look no further than the recent global auto OEM valuation comparables produced by JPM.

One look at the comparable charts and you'll quickly notice that Ferrari is commanding a staggering brand premium from investors.

Just a month after the UK's luxury housing bubble burst, it appears the nice friendly bankers at Barclays are looking for some scapegoats to flip their condos to.

In London, as Bloomberg reported, demand has slumped so badly that developers are offering discounts of up to 20% for their newly constructed homes. And just as the case was in Manhattan, it’s a result of the UK putting in a speed bump. The UK recently increased taxes on those deemed to be purchasing a second home, specifically designed to slow the pace of overseas investment.

Via HardAssetsAlliance.com,

I was sure I misread the title, because everyone instinctively knows this policy is a bad idea… right?

But I didn’t misread it. And it was far from the only article in support of it.

The title was “Get Ready to be Showered by Helicopter Money.” And the voices behind this policy are growing.

Free money to your bank account