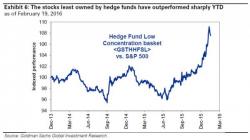

Two Charts Showing How Dazed And Confused Hedge Fund Traders Currently Are

In the aftermath of the recent Valeant and Allergan stock price fiascoes, one month ago we showed that when it comes to 2016 hedge fund performance, it has been an abysmal year for the "smartest money" - something even Warren Buffett touched upon during the weekend - primarily due to the residual clustering effect as over the years hundreds of hedge funds ended up being long the same handful of stocks following numerous self-reinforcing "idea dinners" and quasi-collusive attempts to push up stock prices with coordinated buying.