"Fairness" & Earth's Greatest Currency Manipulator

Exceprted from One River Asset Management's Eric Peters,

“We have created new tools to determine whether an economy may be pursuing foreign exchange policies that could give it an unfair competitive advantage against the United States,” announced the Treasury, late Friday.

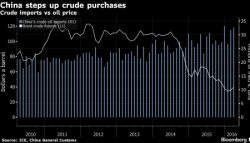

“China, Japan, Germany, and Korea will be closely monitored as a result of a material current account surplus combined with a significant bilateral trade surplus with the United States."