If Draghi's Latest Doesn't Scare You? You Just Aren't Paying Attention

Authored by Mark St.Cyr,

Authored by Mark St.Cyr,

As BofA's Michael Harnett reminds us, on Thursday, April 28th, the US equity "bull market" becomes second longest ever. Next Thursday the current bull market will be 2607 days old, exceeding the bull market of June 1949 to August 1956 by one day; the longest bull market ever was October 1990 to March 2000 (3452 days). The following chart shows the evolution of the three Great Bull Markets.

Here are three point from Hartnett for those curious what may come next.

The Path from No. 2 to No. 1

Fake goods, fake economic growth, fake trade, fake cities, fake human rights, fake country. Real debt.

Forget the G-20 agreement on no "competitive devaluations" - the full court press on the Bank of Japan to engage in the next round of aggressive currency devaluation is on, just three months after Kuroda unveiled Japan's first negative interest rate.

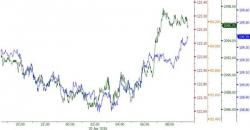

Just three days ago, on April 21, when looking at the technical picture behind the recent bitcoin price action (having covered the extremely favorable fundamentals last September when it was trading at half its current price), we asked if "Bitcoin is about to soar." We were focusing on the bullish pennant formation which suggested a breakout to the upside was imminent.

Moments ago, we got the answer when "soar" is precisely what bitcoin did when following a burst of high volume buying, the digital currency spiked higher by over 4%, to a price of $470...