U.S. Economy 2016: 3 Classic Recession Signals Are Flashing Red

Submitted by Michael Snyder via The Economic Collapse blog,

Submitted by Michael Snyder via The Economic Collapse blog,

Nations representing almost 60%of the world’s oil production will gather in Doha on April 17 to discuss "freezing their output at January levels" in an effort to stabilize prices. According to Bloomberg, Russia, Saudi Arabia, Qatar and Venezuela made a preliminary deal in February and are seeking to add more producers and extend the recent price recovery, but, despite the exuberant squeeze early this week, oil prices are fading modestly as D(oha)-Day looms.

Submitted by Pam Martens and Russ Martens via WallStreetOnParade.com,

The Fed is “one and done” for rate hikes.

We called this back in mid-2015. The US economy is far too weak for the Fed to engage in anything resembling a series of rate hikes. Corporate leverage, household leverage, even the national debt stand at levels that limit the Fed from hiking rates.

The Central Banking insiders know this. Which is why Former Fed Chair Ben Bernanke admitted in private luncheons with hedge fund managers that rates would not “normalize” in his “lifetime.”

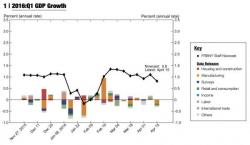

The New York Fed's 'decidedly-more-optimistic-than-Atlanta-Fed's-GDPNow-model' NowCast model for GDP growth just tumbled back to reality after a week of dismal data finally forced its hand. Treasury bond yields are extending their tumble as NYFed slashes Q1 growth to just 0.8% (from 1.5% in Feb) and collapsed Q2 growth to 1.2% from 1.9% last week. This cuts the entire H1 estimate from 1.5% to 1.0%... shamed down to GDPNow's reality.

Q1 cut...

And Q2 slashed...

And what drove the drastic cut...