With Everyone Selling Stocks, Who Is Buying? Goldman Explains

There has been some confusion in recent weeks about one unexplained aspect of the rising market: just who is buying?

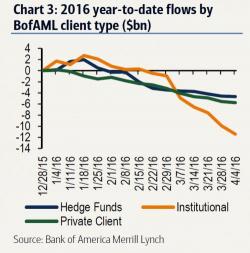

The reason for the confusion is not only the previously documented buyer strike by the smart money (hedge funds, institutions and private clients), which as we reported a few days have sold stocks for 11 consecutive weeks.

Then last night, citing the latest EPFR data, BofA reported that retail equity investors are now also "risk-off" following $6.2 billion in equity outflows from all regions.