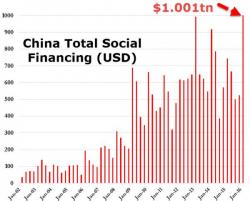

$1,001,000,000,000: China Just Flooded Its Economy With A Record Amount Of New Debt

When China reported its economic data dump last night which was modestly better than expected (one has to marvel at China's phenomenal ability to calculate its GDP just two weeks after the quarter ended - not even the Bureau of Economic Analysis is that fast), the investing community could finally exhale: after all, the biggest source of "global" instability for the Fed appears to have been neutralized.