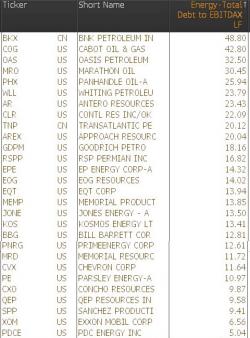

Impatient Banks: A Real Red Flag For The Oil Patch

Submitted by Nick Cunningham via OilPrice.com,

Lenders to the oil and gas industry have been extraordinarily lenient amid the worst downturn in decades, allowing indebted companies to survive a little while longer in hopes of a rebound in oil prices. But the screws are set to tighten just a bit more as the periodic credit redetermination period finishes up.