Who Needs Helicopters? Draghi Plans "Fool-Proof" ECB-Backed Debit Card

Via Mint's Bill Blain's Morning Porridge,

”A common mistake when trying to design something completely fool-proof is to underestimate the ingenuity of complete fools..”

Via Mint's Bill Blain's Morning Porridge,

”A common mistake when trying to design something completely fool-proof is to underestimate the ingenuity of complete fools..”

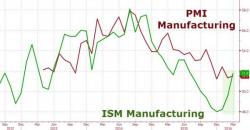

Following China's miraculous PMI jump back into expansion, Markit reports US Manufacturing also rose to 51.5 in March (despite the biggest drop in manufacturing jobs since 2009). As Markit details, output growth is unchanged from February’s 28-month low, and prices charged decline amid further drop in input costs. ISM Manufacturing also jumpedfrom 49.5 to 51.8 - the first 'expansion' in 7 months.

It appears Goldman clients are once again taking a bath. Having proposed that with monetary concerns temporarily sidelined, "good news should be good news for risky assets," today's better-than-expected jobs print (following China's better than expected PMIs) has sent stocks lower, bonds higher, and crack gold and oil...

Stronger USD has sent commodities reeling...

Extending overnight losses from China's "Good" news...

But bonds are bid as stocks slip lower...

And so the confusion remains: why did Yellen go uber dove three days ahead of a day in which the BLS reported that in March not only were 215K jobs created, more than the consensus 205K, if below last month's 245K, but in which average hourly earnings rebounded a solid 0.3%, above the 0.2% expected, and well above last month's -0.1% decline.

Wages rose:

Who could have seen that coming? Ahead of potentially the most important data point of the year - now that The Fed lost its China excuse overnight - NYSE Arca reports a 'glitch'

We are sure it will all be fixed by the time the market opens and the ramping algos have taken back control.

Source: NYSE

Interestingly, futures markets are falling after this 'break'...