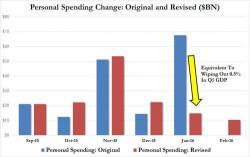

The Fed's Next Headache: One Third Of Q1 GDP Growth Was Just "Revised" Away

On Friday, the US government's Bureau of Economic Analysis had some good and some not so good news: the good news was that the final estimate of Q4 GDP was revised higher from 1.0% to 1.4% (driven by an odd rebound in spending on Transportation and Recreational services). The bad news was that pre-tax earnings tumbled 7.8%, the most since the first quarter of 2011, after a 1.6 percent decrease in the previous three months, suggesting that while it is only the "strong" US consumer that is keeping the US economy afloat on their shoulders.