January 'Bounce' Dies As Fed's National Activity Index Tumbles Back Into Contraction Near 2-Year Lows

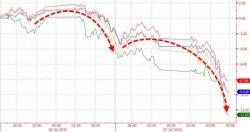

After January's hopeful spike to 6 month highs, Chicago Fed's National Activity Index plunged back into contraction (at -0.29) near 2 year lows.

A shockingly large 58 of the 85 individual indiators within the index made negative contributions to the overall index which printed notably below the lowest economist's expectations.