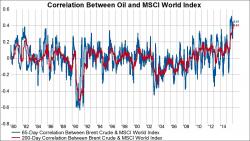

Correlation Between Oil And Stocks Highest Since 1980

Submitted by Eric Bush via Gavekal Capital blog,

Stock prices and oil prices have been moving in a more positive correlated fashion recently than at any point since 1980. The 65-day correlation between Brent Crude Oil and MSCI World Index peaked at 52% on 11/13/2015 and has since fallen back a bit to 41%. The 200-day moving average is also at 41% and continues to climb higher. The current correlation of 41% is the highest correlation between stocks and oil prices ever over the history we have for both series.