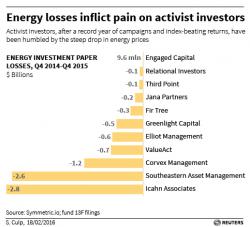

These Activist Investors Have Been Crushed By The Oil Rout

They may end up being right, but they were all way too early.

Activists investors are that special breed of hedge fund managers known for their aggressive forays into situations few others would touch (especially if much, much debt can be issued) usually demanding management, business or board changes. And while sometimes they make a killing thanks to their aggressiveness, other times they themselves are crushed.

Like this time.