Here Is The Real Reason Why Authorities Want To Ban High Denomination Bank Notes

Over the past month, one of the more alarming developments in Europe has been the move to eliminate high denomination bank notes like the €500 bill.

Over the past month, one of the more alarming developments in Europe has been the move to eliminate high denomination bank notes like the €500 bill.

Republican presidential front-runner Donald Trump sold a lot of his stocks and shares a year ago when he realized that he was in a financial bubble. The Donald got out of the market before cheap money and currency wars inflated and destabilized the economy. Billionaire businessman come politician, Donald Trump talks on Fox News about the race for the White House, Syria, Pope Francis, Federal Reserve and the U.S. markets. RealClear Politics reports: “I’m very proud –at first I thought I made a mistake, I sold my stocks, and the market went up, but now I’m way, way ahead,” he said.

Submitted by John Browne via Euro Pacific Capital,

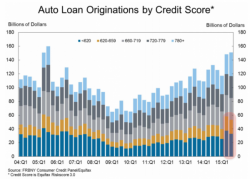

We’ve been shouting from the rooftops about the dangers inherent in the subprime auto market for more than a year.

Auto debt in America has joined student loan debt in the trillion dollar bubble club and part of the reason why is that Wall Street is once again perpetuating the “originate to sell” model whereby lenders relax underwriting standards because they know they’ll be able to offload the credit risk.

It's a day ending in -day, which means it is time for another Jeff Gundlach fire sermon, as transcribed by Reuters. And while in his most recent address to the mortals the new bond king from DoubleLine focused on tremors in the bond market, predicting that "credit fund bankruptcies are coming," and that "the VIX needs to surge above 40 before a bottom can be made in the high-yield junk bond market", today he focused on a topic we have been covering all day, namely the collapse of faith in central bankers and the ascent of gold as a preferred asset class to paper money and bank deposits.