Bloodbathery

Don't just blindly follow someone else's path... (FF to 40 seconds for today's analogy)...

The Nasdaq's collapse now turns it red since the end of QE3 - joing the rest of the US equity party poopers...

Don't just blindly follow someone else's path... (FF to 40 seconds for today's analogy)...

The Nasdaq's collapse now turns it red since the end of QE3 - joing the rest of the US equity party poopers...

We warned earlier in the week that the credit risk of the world's financial institutions were on the rise and that trend has worsened as the week ends.

Global Bank Risk is spiking...

European Bank Risk is blowing out in Core and Peripheral nations...

And China Bank credit risk has broken to new cycle highs..

Some idiocysncratic names to keep an eye on...

To be sure, the rumors have been there for a while.

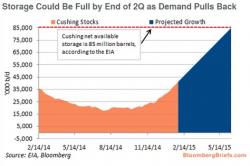

As we first wrote in March of 2015 when it became a topic of conversation, speculation that Cushing may fill, and even overflow, has been around for nearly 10 months.

As we reported then, there were floating predictions that Cushing may top out as soon as the summer of 2015.

After someone decided to dump $1.2 billion notional in gold futures this morning as the jobs data hit - sparking a $20 tumble in the precious metal - it appears stock sellers are greatly rotating to the safety of bullion (over bonds)...

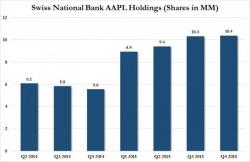

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses - largest hedge fund in Switzerland, its central bank, the Swiss National Bank.