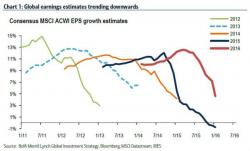

The Stunning Chart Showing Why BofA Remains A Seller Until "A Coordinated, Aggressive Global Policy Response"

While market volatility remains so high it leaves many trading desks speechless by "brutal" if obvious unwinds, and both institutional and retail traders clueless and at best hoping to ride the momentum wave in any direction before it violently reverses, one person who is a steadfast seller into any and every rally is BofA's chief investment strategist Michael Hartnett who in a note titled "Fed, dollar & the end of splendid isolation" explains just why with one simple chart, and further notes that he will continue to sell "at least until a coordinated and aggressive global policy respon