Dow Crashes 350 Points From Post-Fed Highs

Well that escalated quickly...

Dow futures are down over 350 points from the 16,151 knee-jerk fed highs...

Well that escalated quickly...

Dow futures are down over 350 points from the 16,151 knee-jerk fed highs...

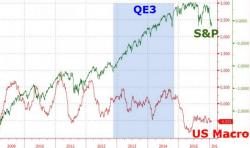

Detailed analysis of economic data is a dying art.

As Bloomberg's Mark Cudmore notes, confirming the detailed and depressing reality of Citi's Matt King, all that investors seem to care about is the performance of financial assets and the related reaction of central banks.

The past seven year bull-market has largely justified the logic of such an approach, but the frenzied panic of the last month raises the question of whether investors will know how to adapt if the framework changes again.

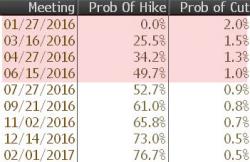

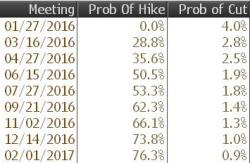

Fed Funds futures now imply the next rate hike will not occur until at least H2 2016 and this level of fear about the economy appears to have spooked stocks and crude and put a bid under bonds and bullion... VIX is chaos as the machines try desperately to get stocks higher...

Not Dovish Enough...

Bonds & Bullion bid...

And VIX is going crazy...

Someone do something!!

Well here we are, a month after liftoff and the world's on fire again, just as it was in late August.

So far in 2016 we've seen continued pressure on crude and just as we saw late last summer, there's big trouble in little China.

Meanwhile, US markets got off to an inauspicious start in 2016 logging what for a time was the worst start to a year in market history.

Surging bonds and bullion and slumping stocks was not what Janet had in mind so she had some 'splaining to do. Hopes for a "passive hawkish" note appear to be met as confirmation of dismal data dependence offers just enough dovishness for the stock bulls and just enough hawkishness for economy bulls.