FOMC Preview: "A Rate Cut Is Very Much In The Mix"

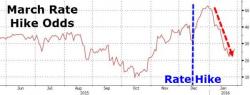

While the odds of a rate hike have collapsed since The Fed's decision to hike rates in the middle of an industrial and earnings recession, the odds of a rate cut remain non-negligible.

As investors await the Fed’s announcement following today’s FOMC meeting, Bloomberg's Richard Breslow they have a conundrum. No change in rates is expected. That is pretty much taken as a given. But we have to add the sub-clause: in either direction. What an interesting concept.