Frontrunning: January 25

- Oil Drops as Saudis to Maintain Spending, China Diesel Use Falls (BBG)

- Saudi Arabia is able to withstand low prices says Saudi Aramco Chairman (WSJ)

- Recession Warnings May Not Come to Pass (WSJ)... or they May

- Problems Found at Theranos Lab (WSJ)

- New York rebounds after blizzard, Washington shuts down government (Reuters)

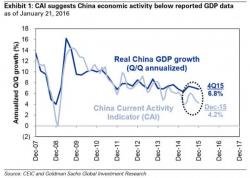

- China business confidence, recruitment hit record lows in January - SMI survey (Reuters)

- Twitter to Revamp Leadership Under CEO Jack Dorsey (WSJ)