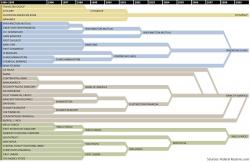

25 Years Of Fed Fueled M&A - The Enabling Of A Banking Oligopoly

The “Big Four” retail banks in the United States collectively hold 45% of all customer bank deposits for a total of $4.6 trillion.

The fifth biggest retail bank, U.S. Bancorp, is nothing to sneeze at, either. It’s got 3,151 banking offices and employs 65,000 people. However, it still pales in comparison with the Big Four, holding only a mere $271 billion in deposits.