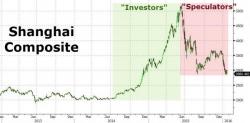

China Promises To Keep Intervening To "Look After" Stock Market "Investors", Hurt "Speculators"

In the most blatant and open admission of direct manipulation, China's Vice President Li told a room full of Davosian elites that China is willing to keep intervening in the stock market to make sure that a few speculators don’t benefit at the expense of regular investors. Following last night's largest liquidty injection in over 3 years (and subsequent plunge in Chinese stocks), it appears the Chinese economic/market "bucket" has more holes than the intervention 'hose pipe' can handle.