The Big Short of 'Mother Frackers'

By EconMatters

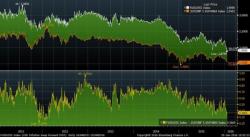

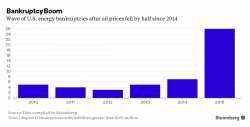

Energy Bankruptcy Boom 2015

Dozens of oil and gas companies went into bankruptcy last year. While energy E&P companies were dropping like flies in 2015, credit rating agencies and banks have remained awfully quiet and apparently buried their heads in the sand.