A Glimpse Of Things To Come: Bankrupt Shale Producers "Can't Give Their Assets Away"

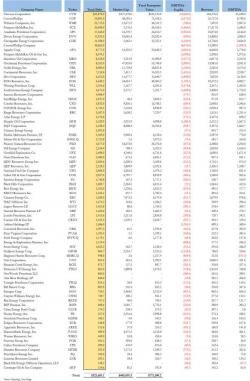

Over the course of the last several weeks, we’ve spent quite a bit of time sounding the alarm bells on America’s growing list of bankrupt oil and gas drillers.

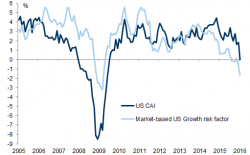

We’ve also been keen to point out that the long list of cash flow negative US producers has only managed to stay in business this long because Wall Street has thus far been willing to plug the sector’s funding gap with cheap financing thanks to ZIRP and investors’ insatiable demand for anything that looks like it might offer some semblance of yield.