"Worst Start To Year Since 2008" But Stocks Bounce On Crude Squeeze, Central Bank Hopes

There's always hope...

Summing the week up perfectly...

Something gotta stick... pic.twitter.com/19pzRhdaGw

There's always hope...

Summing the week up perfectly...

Something gotta stick... pic.twitter.com/19pzRhdaGw

Submitted by Sandro Rosa and Mark Dittli via Finanz und Wirtschaft,

According to macro strategist Felix Zulauf, founder and president of Zulauf Asset Management and Vicenda Asset Management in Zug, the almost seven-year-old bull market is over. China is to the current cycle what the US housing market was for the Global Financial Crisis in 2008. It will take years to correct the excesses that were built up in China.

Mr. Zulauf, the markets had a terrible start into the new year. Is the almost seven-year old equity bull market over?

By EconMatters

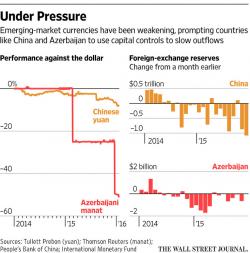

This has not been a good year for emerging markets. Since many of the emerging economies are commodity-reliant (mainly crude oil), the oil price plunge has also crashed their currencies, which prompted money fear and flight.

Back on November 19 of last year, we laid out Goldman's Top 6 trades for 2016 (read the full list here) for the benefit of "those who can't wait to take the other side of Goldman's clients, and thus the same side of Goldman's prop desk." We also noted the 3 big risks which Goldman said could lead to its forecasts crashing and burning, namely "a further fall in commodity prices, in particular crude oil, a devaluation of the Chinese Yuan, and bond yields rising faster than we already anticipate."

Submitted by Brett Arends via MarketWatch.com,

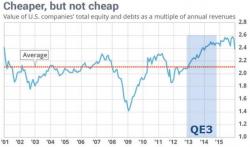

Hard to believe, but the Dow Jones Industrial Average could fall by another 1,000 to 5,000 points and still not be “cheap” compared with long-term stock-valuation measures.

That’s the stark conclusion from an analysis comparing current stock prices to underlying measures such as per-share revenue, earnings and corporate net worth.