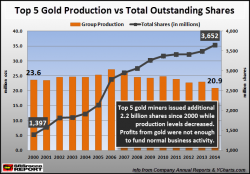

Gold Undervalued Due To Massive Stock Dilution & Debt

Hold your real assets outside of the banking system in a private international facility --> https://www.321gold.com/info/053015_sprott.html

Gold Undervalued Due To Massive Stock Dilution & Debt

Posted with permission and written by Steve St. Angelo, SRSrocco Report (CLICK FOR ORIGINAL)