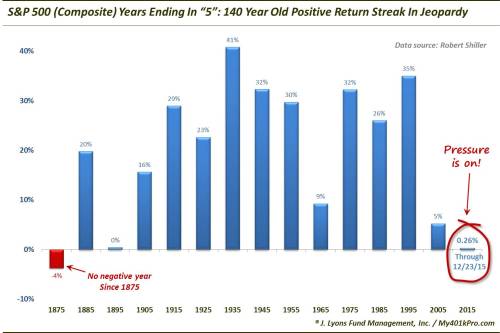

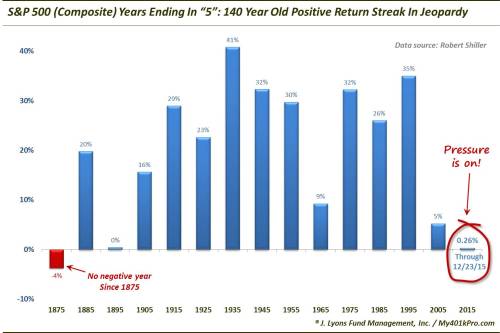

140 Year Old Stock Streak In Jeopardy

Via Dana Lyons' Tumblr,

The U.S. stock market has not been lower for any year ending in a “5″ since 1875…that streak is in jeopardy.

Via Dana Lyons' Tumblr,

The U.S. stock market has not been lower for any year ending in a “5″ since 1875…that streak is in jeopardy.

There are many observations to be made about the dramatic shifts shown in the chart below which demonstrates the top 20 companies by market cap over the past decade, but what, to us, stands out the most are two things:

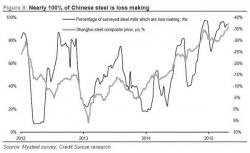

Overnight China's finance ministry reported the latest data on state-owned firms profitability. At a cumulative CNY 2.04 trillion (or $316 billion) for the January-November period, this was another nearly double digit decline, or -9.5% from the year ago period, following a -9.8% drop for the 10 month period the month before.

Authored by David Swensen (Yale CIO) and Jonathan Macey, Op-Ed via NYTimes.com,

America's equity markets are broken. Individuals and institutions make transactions in rigged markets favoring short-term players. The root cause of the problem is that stocks trade on numerous venues, including 11 traditional exchanges and dozens of so-called dark pools that allow buyers and sellers to work out of the public eye. This market fragmentation allows high-frequency traders and exchanges to profit at the expense of long-term investors.

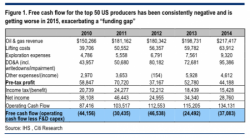

“Two things become clear in an analysis of the financial health of US hydrocarbon production: 1) the sector is not at all homogenous, exhibiting a range of financial health; 2) some of the sector indeed looks exposed to distress [and] lifelines for distressed producers could include public equity markets, asset sales, private equity, or consolidation. If all else fails, Chapter 11 may be necessary.” That’s Citi’s assessment of America’s “shale revolution”, which the Saudis have been desperately trying to crush for more than a year now.