Why The Fed Will Never Succeed

Submitted by Alasdair Macleod via GoldMoney.com,

The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates.

Submitted by Alasdair Macleod via GoldMoney.com,

The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates.

After a year of proclamations from mainstream media (and Wall St. economists) that low oil prices mean low gas prices at the pump which means "bonanza" for US consumers, it appears none of that happened. Confidence is fading fast despite what some suggest is $550 average savings this year as 'gains' flooded into soaring rent and healthcare costs. But, more recently, as stock markets celebrate a soaring oil price (off decade lows), wholesale gasoline prices have soared 10% in a little over 48 hours...

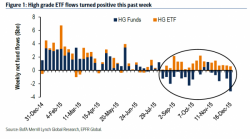

One week ago, in the aftermath of the junk bond tremors unleashed by Third Avenue (which are only just starting) we reported that there had been a historic revulsion toward fixed income fund flows, with unprecedented withdrawals in virtually every bond class, from Investment Grade, to Junk to bank loans. We quoted Bank of America as follows:

If you bring forth that which is within you, that which is within you will save you. If you do not bring forth that which is within you, that which is within you will kill you. No external god. You and we are what you and we are looking for.

Unleash 'The Andy Hall Algo'... it seems the quarter-, year-end mark-ups may just be required to maintain 'some' hedge funds and hold off liquidation for another quarter...

Some context for this latest "The Bottom" in oil...

Even stocks have stopped playing along with oil's silly game...

What next?