"It's Going A Lot, Lot Higher": Novogratz Sees Bitcoin "Easily" Reaching $40,000 Next Year, Ethereum Tripling

"It's going a lot, lot higher"

- Mike Novogratz discussing the price of bitcoin, Nov. 27, 2017

"It's going a lot, lot higher"

- Mike Novogratz discussing the price of bitcoin, Nov. 27, 2017

And the hits keep coming for the unicornest unicorn in all of unicorn-land...

Back in the summer, we suggested - for numerous reasons - that Uber's next round of financing may come at a significant discount to its current $69 billion valuation.

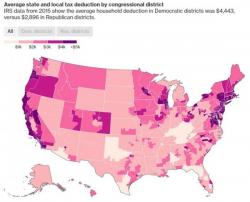

New York's billionaire hedge fund managers have blazed the trail south in recent years with the likes of David Tepper, Paul Tudor Jones and Eddie Lampert all ditching the Empire State for Florida...a state which brings not only pristine beaches and year-round golf weather but also the added benefit of a 0% personal income tax rate.

Jerome Powell, President Trump’s nominee to head the Fed, has released the text of remarks he’ll deliver Tuesday in a confirmation hearing before the Senate Banking Committee.

Powell said he expected the central bank to continue raising its benchmark interest rate and trimming its balance sheet under his leadership, but had some pointed comments over deregulation, economic stability, and the plunge protection team...

Via The Fed,

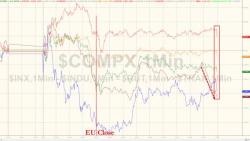

Whatever you do - remember "all is well"

Dow ended higher (with MMM and HD the biggest drivers) as Trannies, Small Caps (ugly into the close), and the Nasdaq red with S&P clinging to unchanged...until the very last minute...