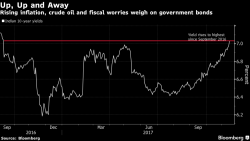

India's Sovereign Bond Market In Trouble As Inflation Rebound Surprises

Another day and another Indian inflation reading comes in “hotter” than markets expected. Yesterday, India’s CPI printed at 3.58% for October 2017 - its highest level in seven months - versus the consensus expectation of 3.43%. The September 2017 reading was 3.28%, itself marking a strong rebound from the recent low of 1.46% in June 2017. Market chatter was that the prospect for a rate cut by the Reserve Bank of India (RBI) when it meets on 5-6 December 2017 was fading.