What German Political Turmoil? Global Markets BTFD, Don't Look Back

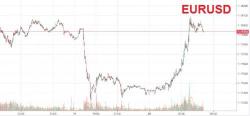

US index futures are unchanged, having recovered virtually all overnight session losses alongside the EURUSD following Merkel's failure to form a government, while European shares rise despite Angela Merkel's failure to form a new government. In the span of just hours, the goalseeked "hot take" consensus was that Germany’s collapsed coalition talks aren’t expected be a deal breaker for European equities due to the "strength of the German economy."